Modelling Technology Application Acceptance of Government Banking and Private Banking Customer on Southern Region of Thailand

Keywords:

Application technology, Application service quality, Relationships Marketing application, Application satisfaction, Acceptance of application technologyAbstract

The objective of the research is to study and develop technology application factors affecting the acceptance of bank customer services. This research is a qualitative and quantitative research. The research instrument was a questionnaire on a sample group of government and private bank customers in the southern region of Thailand. There were a total of 900 customers, divided into 450 respondents of government bank customers and 450 respondents of private bank customers in the southern region of Thailand. The data analysis used the package of SPSS version 22.0 and AMOS version 22.0 statistic values of frequency distribution, percentage, mean, standard deviation and structural equation model analysis (SEM). The results of the research found that the relationship between the variables of the hypothesized path model was significant at p<0.01, and the results of the research hypothesis test indicated that satisfaction through the application acceptance was directly positive influenced by the application technology (β=0.592) service quality (β=0.401) marketing relationship through the application (β=0.379) trust through the application (β=0.463) satisfaction through application acceptance of application technology were directly positive affected by application satisfaction (β=0.851). Therefore. it was concluded that all the variables were positive relationship that affected acceptance of technology by customers of government banks and private banks in the southern region of Thailand. The model is in live with the empirical data. (The chi-square statistic/`degrees of freedom c2/df is equal to=1573.341, p=0.132>0.05 with degrees of freedom 569, RMSEA= 0. 082, GFI= 0.921, AGFI= 0.944, RMR= 0.026)

References

ฑัตษภร ศรีสุข, วราลักษณ์ ศรีกันทา และ เถลิงศักดิ์ สุทธเขต. (2565). การตลาดดิจิทัลและการบริหารงานลูกค้าสัมพันธ์ในสังคมออนไลน์ที่มีผลต่อการตัดสินใจจองที่พักโรงแรมผ่านระบบออนไลน์ของผู้ใช้บริการในจังหวัดลําปางในวิถีชีวิตใหม่. วารสารวิจัยมหาวิทยาลัยเวสเทิร์น มนุษยศาสตร์และสังคมศาสตร์, 8(2), 13.

นงลักษณ์ วิรัชชัย. (2542). โมเดลลิสเรล: สถิติวิเคราะห์สำหรับการวิจัย. พิมพ์ครั้งที่ 3. กรุงเทพฯ: จุฬาลงกรณ์มหาวิทยาลัย.

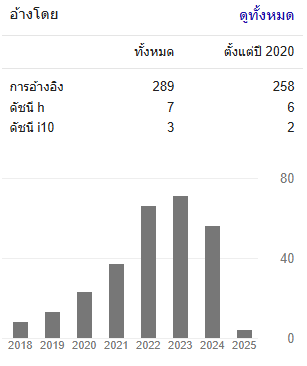

ประชาชาติธุรกิจ. (2564). จำนวนผู้ใช้บริการทำธุรกรรมโมบายแอปพลิเคชัน. สืบค้นเมื่อ 19 มีนาคม 2564, จาก https://www.prachachat.net/finance/news-1400280.

Agyei, J., Sun, S., Abrokwah, E., Penney, E. K. & Ofori-Boafo, R. (2020). Mobile banking adoption: Examining the role of personality traits. SAGE Journals, 10, 1-15.

Budiman, A., Yulianto, E. & Saifi, M, (2020). Pengaruh e-service quality terhadap e-satisfaction dan e-loyalty nasabah pengguna mandiri online. Journal Administrasi Bisnis, 14(1), 1-10.

Chetioui, Y., Lebdaoui, H. & Chetioui, H. (2020). Influential choices: How fashion influencers can affect the purchasing intentions of consumers. Strategic Direction, 36(8), 11-12.

CIO. (2018). Mobile banking market: Mobile technology is revolutionizing banking sector. Retrieved March 18, 2020, from https://www.cio.com.au/mediareleases/32115/mobile-banking-market-mobile-technology-is

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. Mis Q, 13, 319.

Francisca, S. G., TatangIman, S., Dewiana, N., Mochammad, F. & Agus, P. (2021). The Role of Service Quality and Customer Satisfaction on Customer Loyalty Of Mobile Banking Product: An Empirical Study Of Banks In Jakarta. Nat. Volatiles & Essent. Oils, 8(4), 13345-13360.

Gautam, V. & Sharma, V. (2017). The Mediating Role of Customer Relationship on the Social Media Marketing and Purchase Intention Relationship with Special Reference to Luxury Fashion Brands. Journal of Promotion Management, 23, 1-17.

Grossman, N. (2017). Thailand’s sustainable development (source book). Bangkok: Editions Didier Millet

Grossman, R. P. (1998). Developing and managing effective consumer relationships. Journal of Product & Brand Management, 7(1), 27-40.

Hair, J. F., Black, W.C., Babin, B.J. & Anderson, R. E. (2010). Multivariate data analysis. 7thed. New York: Pearson.

Ho, J. C., Wu, C. G., Lee, C. S. & Pham, T. T. (2020) Factors affecting the behavioral intentions to adopt mobile banking: An international comparison. Technology in Society, 63, 101360. https://doi.org/10.1016/j.techsoc.2020.101360

Hu, Z., Ding, S., Li, S., Chen, L. & Yang, S. (2019). Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry, 11, 340.

Kumar, A., Dhingra, S., Batra V. & Purohit, H. (2020). A framework of mobile banking adoption in India. Journal of Open Innovation: Technology, Market, and Complexity, 6(2), 40.

Lansing, J. & Sunyaev, A. (2016). Trust in Cloud Computing: Conceptual Typology and Trust-Building Antecedents. Data Base, 47(2), 58-96.

Malaquias, R. F. & Hwang, Y. (2019). Mobile banking use: a comparative study with Brazilian and U.S. participants.Int. J. Inf. Manag, 44, 132-140.

Martins, C., Oliveira, T. & Popovic, A. (2014). Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. Int. J. Inf. Manag, 34, 1-13.

Morgan, R. & Hunt, S. (1994). The commitment-trust theory of relationship marketing. Journal of Marketing, 58(3), 20-38.

Ndubisi, N. O. & Wah, C. K. (2005). Factorial and discriminant analyses of the underpinnings of relationship marketing and customer satisfaction. International Journal of Bank Marketing, 23(7), 542-557.

Palmatier, R.W., Dant, R.P., Grewal, D. & Evans, K.R. (2006). Factors Influencing the Effectiveness of Relationship Marketing: A Meta-Analysis. Journal of Marketing, 70, 136-153.

Rahman, A., Hasan, M. & Mia, A. (2017). Mobile banking service quality and customer satisfaction in bangladesh: An analysis 26 the cost and management. The Cost and Management, 45(2), 134-135.

Rai, R., Kharel, S., Devkota, N. & Paudel, U. R. (2019). Customers Perception on Green Banking Practices: A Desk Review. The Journal of Economic Concerns, 10(1), 82-92.

Shankar, A. & Jebarajakirthy, C. (2019). The influence of e-banking service quality on customer loyalty: a moderated mediation approach. Int. J. Bank Mark, 37, 1119–1142.

Shankar, A., Jebarajakirthy, C. & Ashaduzzaman, M. (2020). How do electronic word of mouth practices contribute to mobile banking adoption? Journal of Retailing and Consumer Service, 52, 101920. https://doi.org/10.14016/j.jretconser.2019.101920

Sharma, S. K. & Sharma, M. (2019). Dimensions in the actual usage of mobile banking services: An empirical investigation. International Journal of Information Management, 44, 65-75.

Shilpa, D. & Veena, K. P. (2018). Customer satisfaction on adoption of mobile banking services: a study with special reference to state bank of india. Journal of Business and Management (IOSR-JBM),20(1),44-50.

Suharsono, A., Lontoh, L. & Maulidia, M. (2021). Indonesia’s energy policy brie ng. Global Subsidies Initiative of the International Institute for Sustainable Development. Retrieved September 22, 2022, from https://www.iisd.org/system/les/2021-03/Indonesia-energy-policy-brieng-february-2021-en.pdf

Tiwari, P., Tiwari, S. K. & Gupta, A. (2021). Examining the impact of customers’ awareness, risk and trust in m-banking adoption. FIIB Business Review, 10(4), 413-423.

Waite, K. (2006). Task scenario effects on bank web site expectations. Internet Research, 16(1), 7-22.

Welta, F. & Lemiyana, L. (2017). Pengaruh car, inflasi, nilai tukar terhadap profitabilitas pada bank umum syariah. I-Finance: A Research Journal on Islamic Finance, 3(1), 53-66.

Yaseen, S. G. & El Qirem, I. A. (2018). Intention to Use E-Banking Services in the Jordanian Commercial Banks. International Journal of Bank Marketing, 36, 557-571.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Ammara Phakdeeburi

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

ผลงานที่ปรากฎในวารสารฉบับนี้เป็นลิขสิทธิ์เฉพาะส่วนบุคคลของผู้เขียนซึ่งต้องรับผิดชอบต่อผลทาง กฎหมายที่อาจเกิดขึ้นได้และไม่มีผลต่อกองบรรณาธิการ