Causal Factors that Influences Personal Retirement Planning of Private Company Employee in Thailand

Keywords:

Financial Literacy, Financial Behavior, Retirement Investment, Retirement Planning, Financial well-beingAbstract

Retirement planning is the process of determining retirement income goals. The purpose of saving for spending or enough to live in the future. If you don’t have a good financial plan, it can affect your life after retirement. This academic article aims to purposes the causal factors that influences personal retirement planning of private company employee in Thailand. To explain meanings, variables and relationship related to retirement planning. The conclusion from review show that variables use in various studies is financial literacy, financial behavior, retirement investment and financial well-being. The result of this study to apply causal factors that influences the personal retirement planning in financial planning to achieve retirement financial goals.

References

นพรัตน ศรีศุภภัค. (2560). กลยุทธ์การจัดสรรการลงทุนในสินทรัพย์ และกลยุทธ์การลงทุนแบบโมเมนตัมอุตสาหกรรม สำหรับการวางแผนการลงทุนเพื่อเกษียณอายุ. นักศึกษาปริญญาเอก คณะบริหารธุรกิจ มหาวิทยาลัยธุรกิจบัณฑิตย์.

ประชา บุญมา และ วิชิต อู่อ้น. (2564). ปัจจัยเชิงสาเหตุที่มีอิทธิพลต่อการวางแผนเกษียณอายุของพนักงานบริษัทเอกชนในประเทศไทย. นักศึกษาปริญญาเอก วิทยาลัยบัณฑิตศึกษาด้านการจัดการมหาวิทยาลัยศรีปทุม.

Agarwal, S., Amromin, G., Ben-David, I., Chomsisengphet, S., Evanoff, D.D., (2015). Financial literacy and financial planning: evidence from India, Journal of Housing Economics, 27, 4-21.

Ajzen & Fishbein. (2005). Intention Model Analysis of Bogor Society against Pension Fund in Retirement Planning. International Journal of Managerial Studies and Research (IJMSR), 6, 15-30.

Ajzen, I. (1988). Attitudes, personality, and behavior. Milton-Keynes, England:Open University Press & Chicago, IL: Dorsey Press.

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50, 179-211.

Ajzen, I., & Fishbein, M. (1980). A theory of reasoned action. Englewood Cliffs. NJ: Prentice-Hall

Behrman, J. R., Mitchell, O. S., Soo, C. K., & Bravo, D. (2012). How Financial Literacy Affects Household Wealth Accumulation. American Economic Review, 102(3).

Beshears et al.,(2011). Financial Factors Affecting Retirement Planning by Savings and Credit Cooperative Employees in Nakuru Town, Kenya. The International Journal of Business & Management, 5, 131–149.

Bodie, Z., Treussard, J., & Willen, P. (2007). The theory of life‐cycle saving and investing. (FRB of Boston Public Policy Discussion Paper No. 07-3). Retrieved from http://dx.doi.org/10.2139/ssrn.1002388

Chaffin, C.R. (2013). The financial planning competency handbook. Canada: John Wiley& Sons.

Coile. (2015). Financial Factors Affecting Retirement Planning by Savings and Credit Cooperative Employees in Nakuru Town, Kenya. The International Journal of Business & Management, 5, 131–149.

Dahlia Ibrahim, Zuraidah Mohamed Isa & Norhidayah Ali. (2012). Malaysian Savings Behavior towards Retirement Planning, International Conference on Economics Marketing and Management, IPEDR, 28(2012) IACSIT Press, Singapore.

Davis, G. D., & Chen, Y. (2014). Age Differences in Demographic Predictors of Retirement Investment Decisions, (October 2014), 37–41. https://doi.org/10.1080/03601270701838365.

Folk Jee Yoong (2012). Financial Literacy Key to Retirement Planning in Malaysia. Joumal of Management and Sustainability, 2, 75-86.

Garman & Forgue. (2011). Financial Factors Affecting Retirement Planning by Savings and Credit Cooperative Employees in Nakuru Town, Kenya. Jomo Kenyatta University of Agriculture and Technology, 1-23.

Geng Niu and Yang Zhoub.,(2018), Financial literacy and retirement planning: evidence from China, Applied Economics Letters, 25, 619–623.

Hershey, D.A. (2004). Psychological influences on the retirement investor. CSA Journal: Certified Senior Adviser, 22, 31-39.

Joo, S. H., & Grable, J. E. (2005).Employee education and the likelihood of having a retirement savings program. Journal of Financial Counselling and Planning, 16, 37–49.

Joo. (1998). In Pursuit of Financial Well-being: The Effects of Financial Literacy, Financial Behaviour and Financial Stress on Employees in Labuan. International Journal of Service Management and Sustainability, 3, 55-94.

Kapoor, J.R., Dlabay, L.R. & Hughes, R.J. (2009).Personal Finance. 9thed. McGraw-Hill Irwin.

Kepha Nyamweya Mokaya , Kimani Maina. (2018). Financial Factors Affecting Retirement Planning by Savings and Credit Cooperative Employees in Nakuru Town, Kenya, Jomo Kenyatta University of Agriculture and Technology, 1-23.

Lokanath Mishra. (2015). Financial Planning for Educated Young Women in India. Research Journal of Finance and Accounting, 6, 88-100.

Lusardi A. and Mitchell, O.S. (2009). How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness (No. w15350). National Bureau of Economic Research.

Lusardi, A., & Mitchell, O. (2006). Financial literacy and planning: Implication for retirement well being. Pension Research Council, 10(4), 509-525.

Mithcell, O.,&Utkus, S. (2006). How behavioral finance can inform retirement plan design. Journal of Corporate Finance, 18(1), 82-94.

Njuguna, A. G., & Otsola, J. (2011). Predictors of Pension Finance Literacy: A Survey of Members of Occupational Pension Schemes in Kenya. International Journal of Business Management, 6(9), 101-112.

OECD. (2014), Lusardi. (2008). A Structural Equation Modelling Study of the Determinants of Retirement Preparedness. International Journal of Innovation, Creativity and Change, 11, 1-24.

Overton, R. H. (2007). An empirical study of financial planning: Theory and practice. (Unpublished doctoral dissertation). Minneapolis, MN: Capella University.

Ratneswary Rasiaha, Felicia Mathew Bilongb, Jason James Turnerc, Hassam Waheedd, Sotheeswari Somasundrame, Kelly Pei Leng, Teef. (2020). A Structural Equation Modelling Study of the Determinants of Retirement Preparedness. International Journal of Innovation, 11, 1-24.

Sani Dauda , Habibah Tolos and Yusnidah Ibrahim. (2017).The Direct Predictors of Retirement Planning Behavior: A Study of Nigerian Workers, IOSR Journal of Business and Management, 9, 41-49.

Selvadurai. (2018). Factors Influencing Financial Planning Retirement amongst Employees in The Private Sector in East Coast Malaysia: Literature Review and Research Agenda. FGIC 2nd Conference on Governance and Integrity 2019. 1115-1129.

Shashi Kiran Poudyal. (2019).Factors Affecting Retirement Confidence Among Workers' Working in Nepalese Private Sector, SOMTU Journal of Business and Management Research, 1-20.

Shefrin, Hersh. (2001). Beyond Greed and Fear: Understanding Behavioral Finance and Psychology of Investing. Harvard Business School Press.

Tapia and Yermo. (2007). Helping South Africans Achieve a Better Income in Retirement: A Critical Evaluation of the Impact of Treasury Proposals. Journal of Economic and Financial Sciences, 185-202.

Yuh, Y., Montatlo, C.and Hanna, S. (1998). Are Americans prepared for retirement? Financial Counselling and Planning, 9(1), 1-12.

Translated Thai References

Bunma, P. and U-on, V. (2021). Causal factors that influences personal retirement planning of private company employee in Thailand. Ph.D. Candidate, Doctor of Business Administration Graduate College of Management Sripatum University (in Thai)

Srisuppak, N. (2017). Asset Allocation and Industry Momentum Strategy for Retirement Planning Ph.D. Candidate, Faculty of Business Administration, Dhurakij Pundit University (in Thai)

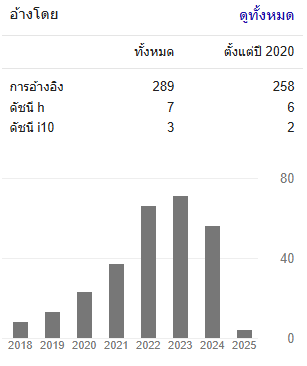

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Pracha Bunma

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

ผลงานที่ปรากฎในวารสารฉบับนี้เป็นลิขสิทธิ์เฉพาะส่วนบุคคลของผู้เขียนซึ่งต้องรับผิดชอบต่อผลทาง กฎหมายที่อาจเกิดขึ้นได้และไม่มีผลต่อกองบรรณาธิการ